Britain’s biggest bank, HSBC, recently agreed to a record $1.92 billion settlement with U.S. authorities over charges that it laundered billions of dollars tied to Latin American drug cartels, so-called “rogue states,” and foreign terrorist organizations. Although the U.S. Department of Justice (DOJ) has made a show of these massive money-laundering settlements in recent years, the fact that U.S. authorities have cowered from actually prosecuting these massive crimes shows how illicit financial flows remain a structural—and perhaps increasingly necessary—pillar of the global capitalist system.

Britain’s biggest bank, HSBC, recently agreed to a record $1.92 billion settlement with U.S. authorities over charges that it laundered billions of dollars tied to Latin American drug cartels, so-called “rogue states,” and foreign terrorist organizations. Although the U.S. Department of Justice (DOJ) has made a show of these massive money-laundering settlements in recent years, the fact that U.S. authorities have cowered from actually prosecuting these massive crimes shows how illicit financial flows remain a structural—and perhaps increasingly necessary—pillar of the global capitalist system.

According to the NY Times, DOJ officials feared “criminal prosecution would topple the bank and, in the process, endanger the financial system.” Although the money-laundering business of major banks is being exposed, U.S. investigators insist the banks are too big to indict. They claim criminal prosecution could have destabilizing “collateral consequences” that would ripple across the world financial system.

Matt Taibbi at Rolling Stone joked HSBC laundering activities “could have been spotted from space.” Indeed, Assistant Attorney General Lanny Breuer explained Mexican cartel operatives would show up to HSBC branches in Mexico with “hundreds of thousands” of dollars packed into boxes that were custom-made to snugly fit through the bank’s teller windows. All told, HSBC laundered an estimated $881 million in narco dollars and processed $660 million in funds from “rogue” states.

Breuer said HSBC had “failed to monitor over $670 billion in wire transfers from HSBC Mexico between 2006 and 2009, and failed to monitor over $9.4 billion in purchases of physical U.S. dollars from HSBC Mexico over that same period.” In Newspeak, “failed to monitor” stands in for “complicity.”

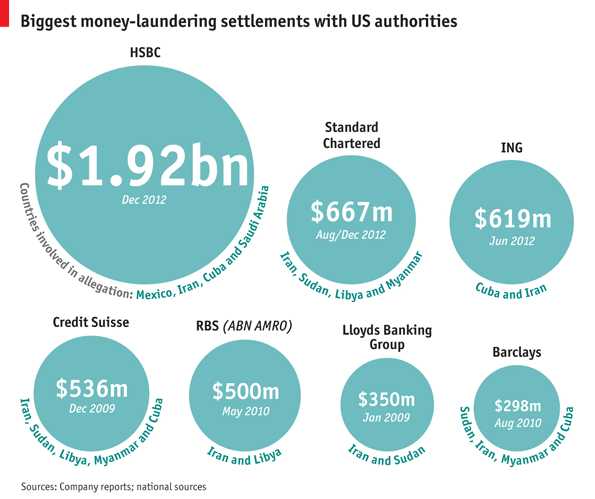

The HSBC scandal—or at least, what should be a scandal—comes on the heels of several other major settlements with money-laundering banks, as shown in the chart below by The Economist.

However, the chart does not include a series of lower settlements like the $160 million paid in 2010 to the DOJ by Wachovia, a unit of Wells Fargo. Fines like Wachovia’s pale in comparison to the laundering of $720 million in cash by a single Mexican front company discovered in the Wachovia investigation. In this case, the money laundering worked its way through the same networks of currency exchanges and wire transfers used by immigrant remittances. Despite being an integral part of global criminal enterprises, banks like HSBC and Wachovia are being let off the hook (HSBC’s $1.9 billion fine is about five week’s pay for the bank). The fines have simply become the cost of doing (shady) business.

The international financial system is literally banking on the blood money being paid with the carnage of the drug war in places like Mexico, where drug-fueled violence has claimed the lives of 60,000 people since 2006. And the murder rate in Guatemala is now higher than it was during the country’s 36-year genocidal war.

It’s not surprising to find that amid these cash-strapped times—an increasingly systemic feature of our economic system—narcos have found major banks willing to take their staggering sums of hard cash and look the other way. In fact, during his tenure as chief of the UN’s Office on Drugs and Crime, Antonio Costa openly suspected narco dollars might have helped many financial firms hobble through the worst of the financial crisis

“In the second half of 2008, liquidity was the banking system’s main problem and hence liquid capital became an important factor,” Costa told an Austrian magazine in 2009. “It appears that interbank credits have been financed by money which comes from the drug trade and other illegal activities. It is naturally hard to prove this, but there are indications that a number of banks were rescued by this means.”

Despite the growing roster of banks being investigated and/or fined by U.S authorities, not a single bank executive has faced criminal charges.

The first in a three-part series on narco-geographies; Part II will look at elements of the political ecology of the drug economy and Part III will shed some light on how narco dollars can drive an urban real estate and construction bubble.

Pingback: Narco-Geographies, Part II: Political Ecology of the Drug Economy | Territorial Masquerades

Pingback: Narco-Geographies, Part III: Urban Speculation and Spectacle | Territorial Masquerades